When Atlas Components Pvt. Ltd., a small electronics importer from Pune, brought in precision sensors from Taiwan, the consignment worth ₹1.2 crore got stuck at Nhava Sheva for a week. The reason? A single digit error in the HS Code entry.

That small oversight led to demurrage charges of ₹5.6 lakh and missed delivery deadlines with their client in Bengaluru.

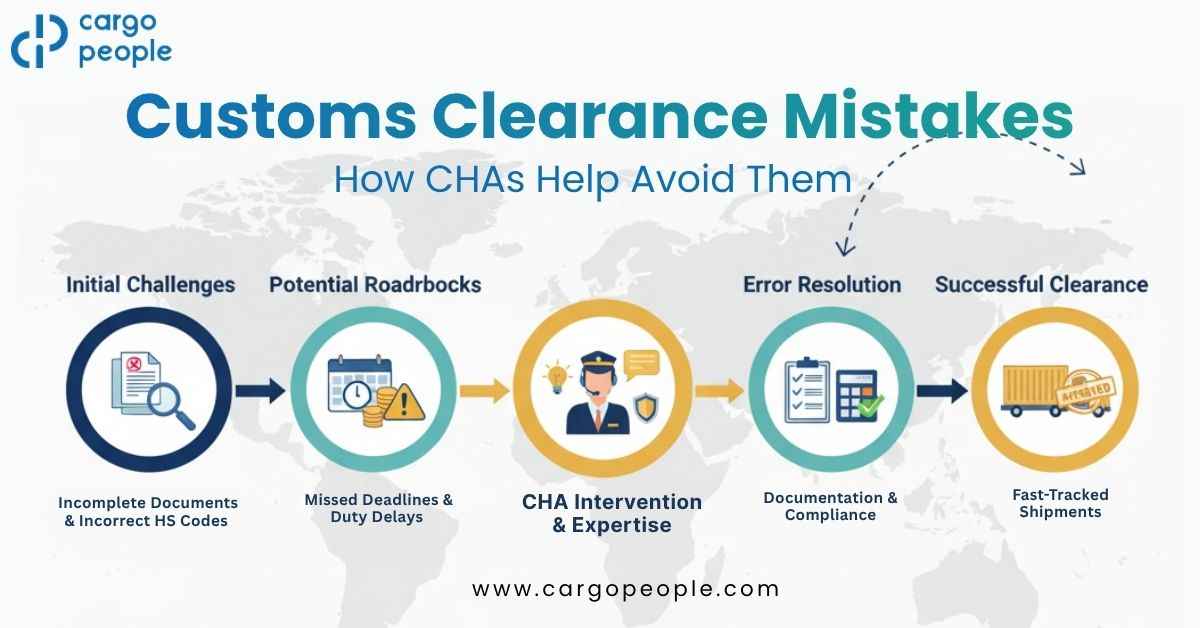

Such incidents are common across Indian ports. Documentation gaps, duty miscalculations, and regulatory confusion can bring even seasoned traders to a halt.

The good news: every one of these mistakes is preventable with the right guidance. That’s exactly what a licensed Customs House Agent (CHA) brings — expertise, accountability, and speed.

1. Missing or Mismatched Documentation

Why It Happens:

Importers often assume the documents from suppliers are error-free. But mismatched invoice values, unverified packing lists, and inconsistent data between the Bill of Lading and Bill of Entry cause immediate red flags during customs assessment.

Typical Mistakes

-

Different product descriptions across documents

-

Missing Import Export Code (IEC) or GST number

-

Unattested certificates of origin

-

Non-matching weights or product counts between invoice and manifest

How CHAs Prevent It

-

Conduct line-by-line document validation before filing

-

Use digital document checklists mapped to ICEGATE requirements

-

Coordinate directly with shipping lines and DGFT offices for quick corrections

Real Impact:

An apparel importer from Tiruppur avoided three days of port detention when his CHA corrected a packing list discrepancy before the vessel even berthed.

2. Wrong HS Classification or Customs Valuation

Why It Matters:

Incorrect tariff classification under the Customs Tariff Act 1975 can lead to under- or over-payment of duty and trigger audits or penalties under Section 111 of the Customs Act.

Common Scenarios

-

Using supplier HS codes that differ from Indian Customs schedules

-

Ignoring new CBIC notifications updating duty rates

-

Declaring accessories or composite goods separately instead of together

How CHAs Help

-

Verify each HS code with the latest CBIC tariff and Exim policy database

-

Apply correct valuation methods under the Customs Valuation Rules 2007

-

Maintain updated product-wise classification sheets for recurring shipments

Business Example:

A Pune auto-parts importer saved ₹14 lakh in potential duty penalties when their CHA re-classified steering columns under the correct tariff chapter before assessment.

3. Ignoring Import Licenses and Regulatory Approvals

The Problem:

Many shipments fall under restricted categories — electronic waste, medical devices, chemicals, or food items — and need pre-approval from authorities like DGFT, FSSAI, or MoEFCC.

Consequences of Non-Compliance

-

Shipment detention until a valid license is produced

-

Additional inspection fees and storage costs

-

Legal notices under Foreign Trade (Development and Regulation) Act

How CHAs Handle It

-

Cross-verify each item with the ITC (HS) Schedule before shipment

-

Coordinate with DGFT and allied agencies for advance NOC applications

-

Schedule product testing or inspection if required by the importing port

Result:

At Mundra Port, a CHA cleared a perishable shipment of nutraceuticals within 24 hours by arranging pre-arrival FSSAI inspection — saving the importer ₹2 lakh in cold-storage costs.

4. Misunderstanding Incoterms and Responsibility Division

Why It Happens:

Incoterms (FOB, CIF, DDP etc.) define who pays for freight, insurance, and customs duty. Many Indian traders still rely on old contracts or informal communication, causing confusion in customs valuation.

Common Pitfalls

-

Assuming freight cost is already included under FOB terms

-

Double-counting insurance in customs valuation

-

Paying duties on charges that are exempt under CIF

How CHAs Help

-

Review purchase contracts and Incoterms before shipment booking

-

Reconcile freight invoices with valuation sheets for customs filing

-

Advise importers/exporters on optimal Incoterm choices based on risk exposure

Mini Case:

A Mumbai-based machinery importer avoided ₹2.3 lakh in excess duty when the CHA re-filed valuation documents using correct CIF terms.

5. Late Filing and Missed Deadlines

The Reality:

After an Import General Manifest (IGM) is filed, importers get only a small window to submit the Bill of Entry. Every day of delay adds demurrage and storage charges — typically ₹8,000–₹10,000 per container per day.

How CHAs Add Value

-

Track vessel ETA and manifest updates in real time via ICEGATE

-

Pre-file Bills of Entry before vessel arrival wherever allowed

-

Use the Authorized Economic Operator (AEO) channel for faster assessment

Measured Impact:

Working with a proactive CHA can cut average clearance time by up to 40%, especially at busy ports like Nhava Sheva and Chennai.

6. Overlooking Frequent Regulatory Changes

The Challenge:

CBIC and DGFT issue frequent circulars revising import duties, license requirements, or document formats. Missing an update can halt an otherwise compliant shipment.

How CHAs Keep Clients Safe

-

Subscribe to CBIC Trade Notices and DGFT updates daily

-

Verify each declaration against the latest EDI requirements

-

Maintain a compliance log for every importer/exporter they represent

Outcome:

An electronics importer avoided detention when his CHA spotted a new CBIC notification changing duty on lithium batteries a week before his cargo arrived.

Data Table 1 – Average Customs Clearance Timelines (2024-25)

| Major Port | Avg. Import Clearance Time (Days) | Avg. Export Clearance Time (Days) |

|---|---|---|

| Nhava Sheva (JNPT) | 2.5 | 1.8 |

| Mundra (Gujarat) | 2.1 | 1.6 |

| Chennai Port | 3.2 | 2.4 |

| Kolkata Dock System | 3.5 | 2.7 |

| ICD Tughlakabad | 2.8 | — |

Interpretation:

Companies working with experienced CHAs often clear shipments up to a day faster than self-managed filings — directly reducing demurrage costs and port congestion fees.

Data Table 2 – Financial Impact of Common Mistakes

| Mistake Type | Average Financial Impact (₹) | Typical Delay | How a CHA Mitigates It |

|---|---|---|---|

| Wrong HS Code | 1 – 5 lakh in penalty | 3 – 7 days | Pre-classification audit |

| Missing Documents | 50 k – 2 lakh | 1 – 3 days | Document checklist & cross-verification |

| Missing License/NOC | 3 – 10 lakh + storage | 7 – 15 days | Advance DGFT/FSSAI coordination |

| Late Bill of Entry | ₹25,000 – ₹1 lakh per day demurrage | 1 – 5 days | Real-time vessel tracking & pre-filing |

Mini Business Snapshots

-

Apparel Exporter – Tirupur: Avoided ₹2.5 lakh in air freight by switching to sea consolidation advised by their CHA.

-

Machinery Importer – Rajkot: Cleared ₹1.2 crore shipment within 48 hours using CHA-led pre-clearance.

-

Pharma Manufacturer – Hyderabad: Avoided consignment detention through real-time license validation handled by their CHA team.

Each success story shows that behind every on-time shipment is meticulous coordination and compliance knowledge.

Compliance and Operational Risks

Non-compliance is not just a paperwork issue — it’s a financial and reputational risk. Under the Customs Act 1962, penalties can include cargo confiscation and prosecution. A CHA acts as a compliance guardian: interpreting circulars, filing declarations accurately, and ensuring that importers stay aligned with DGFT, CBIC, and port-specific regulations.

For Indian businesses expanding globally, a trusted CHA is more than a broker — they are your in-house compliance arm.

Conclusion — Precision Over Paperwork

In the fast-paced world of global trade, every shipment carries risk — from an unchecked invoice to an outdated regulation.

Choosing to partner with a licensed Customs House Agent transforms that risk into reliability. Their expertise saves time, cuts cost, and safeguards your reputation.

When your cargo’s journey depends on precision, a CHA ensures every document, duty, and declaration lines up perfectly.

📞 Talk to a Customs Expert Today

Reach out to Cargo People Logistics — trusted CHA and freight partner for India’s leading exporters and importers.

📞 +91 78350 06245 | 📧 cha@cargopeople.com

Book a Consultation Now — Simplify Your Clearance Process.

United Kingdom

United Kingdom

Germany

Germany

Argentina

Argentina

Australia

Australia

Canada

Canada

New Zealand

New Zealand